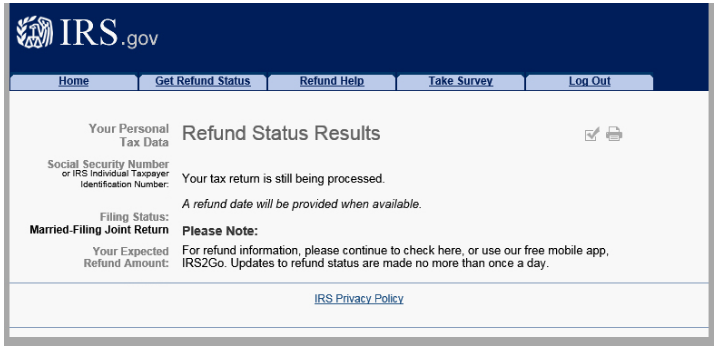

“The employer can discipline the employee for whatever loss was incurred, but again, unless there was an agreement in place, they can’t take that money out of the employee’s paycheck,” Chan said. Once the settlement check clears, your lawyer will distribute your settlement money.Ĭan an employer take money out of an employee’s paycheck? This is only temporary, and it’s not your attorney’s decision - it’s a mandatory part of the settlement process under State Bar of Texas rules. Upon receipt, your attorney will deposit the insurance check into a special trust or escrow account. What happens after my attorney receives my settlement check? If your payment has not been processed, you will need to call IRS e-file Payment Services at 1-88 or contact your state tax agency, as appropriate. It shouldn’t take more than 7-10 days past the payment date specified for the funds to be withdrawn. How long does it take for IRS to withdraw payment? If you are receiving your refund via a check in the mail, once the IRS shows it has been mailed, it can take 5-7 business days to receive the check. How long does it take to receive IRS check once mailed? If it’s been at least two weeks since you sent the payment to the IRS and your financial institution verifies that the check hasn’t cleared your account, call the IRS’s toll-free number at 80 to ask if the payment has been credited to your tax account. How do I know if the IRS received my payment? In prior years, the IRS issued more than 9 out of 10 refunds to taxpayers in less than 21 days last year. Only the IRS knows the status of processing your tax return, whether you owe taxes or are due a refund. Once you are accepted, you are on the IRS payment timetable.

How long does it take to receive taxes after they have been accepted? If you file your return electronically, your refund should be issued in less than three weeks, even faster when you choose direct deposit. If you file a complete and accurate paper tax return, your refund should be issued in about six to eight weeks from the date IRS receives your return. How long does a paper check take for IRS? Looking for emails or status updates from your e-filing website or software.Calling the IRS at 1-80 (Wait times to speak to a representative may be long.).How do I know if my paper tax return has been processed?įind out if Your Tax Return Was Submitted 6 Can an employer take money out of an employee’s paycheck?.5 What happens after my attorney receives my settlement check?.4 How long does it take for IRS to withdraw payment?.3 How long does it take to receive taxes after they have been accepted?.2 How long does a paper check take for IRS?.

1 How do I know if my paper tax return has been processed?.

0 kommentar(er)

0 kommentar(er)